“Vietnam’s recently introduced policy change allowing foreign investors to acquire land, and to own and operate data centers without a local partner, has demonstrated the Government’s commitment to boosting digital infrastructure across the country,” said head of Insights and Analysis for Cushman & Wakefield’s Asia Pacific Data Centre Group, Pritesh Swamy.

|

|

|

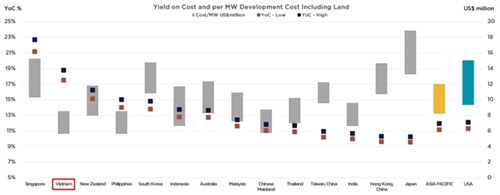

Yield-on-cost and per MW Development Cost Including Land, 2025 (Photo courtesy of Cushman & Wakefield) |

“Data centers have been classified as “high-priority technology” for development and investment, and we expect to see further interest from international investors in the months to come,” he said.

Vietnam is rapidly emerging as a strategic destination in the Asia-Pacific data center investment landscape, with a yield-on-cost second only to Singapore.

The Cushman & Wakefield Asia Pacific Data Center Investment Landscape report found the yield-on-cost for data center investments in Vietnam to be in the range of 17.5% to 18.8%, behind Singapore’s 21% to 23%.

This positions Vietnam as one of the most attractive emerging markets, driven by surging demand, competitive development costs, and proactive government support, the company said.

The average development cost, including construction and land costs, per megawatt (MW) of data center capacity in Vietnam is approximately 7.1 million USD. This is significantly below the regional average of 10.1 million USD/MW and nearly half the cost of development in Japan, which is the region’s most expensive market at 16.1 million USD/MW.

By 2030, the total capital expenditure requirement for planned data center projects in the country is estimated at 755 million USD.

While this figure is modest compared to major markets such as Japan (47 billion USD), Australia (21 billion USD), or Malaysia and India (20 billion USD each), it underscores the market’s early-stage growth and high return potential.

Vietnam’s current capitalization rate ranges from 7% to 8%, well above the regional average of 5.8%, offering an attractive risk premium for forward-looking investors.

Furthermore, Vietnam’s infrastructure shortfall is part of a broader regional trend, highlighting robust demand amid constrained supply. The Asia-Pacific region averages over 350,000 people per MW of colocation capacity, several times higher than the U.S.

In Vietnam, this figure exceeds 1.77 million people per MW, among the highest in the region. Even if all under-construction and planned projects are completed by 2030, the country would still face a significant shortfall, with a projected density of 692,563 people per MW.

According to Cushman & Wakefield, Vietnam’s macroeconomic fundamentals further support the sector’s growth. Although the country has yet to reach a 1 trillion USD GDP like some regional peers, it is among the fastest-growing economies, with strong breakout potential.

Cushman & Wakefield’s analysis shows that markets with GDPs under 1 trillion USD - including Vietnam, the Philippines, Thailand, Taiwan (China), and New Zealand - account for 7% of regional GDP but only 5% of total data center capacity, indicating substantial headroom for expansion.

Source: VNA