In recent years, non-cash payment has been expanded in the country with various forms: via bank cards, mobile phones and mobile banking apps, internet banking or e-wallets, with the payment by bank cards the most common.

Dr. Nguyen Thi Thanh Van from the Banking Academy’s International Business Faculty said that since the bank cards made debut in 1996, the number of cards as of June 2016 exceeded 106 million, a 3.4-fold rise compared with that of late 2010.

|

|

|

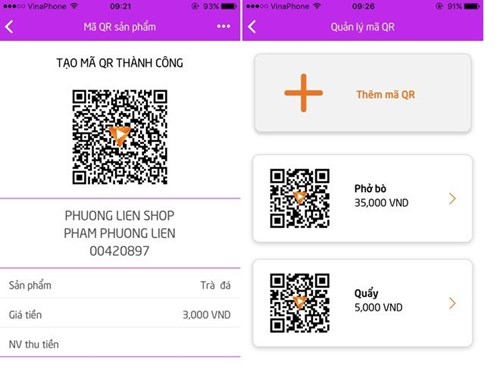

Many banks are stepping up QR code payment on mobile phones |

Most of the banks are providing internet banking services, and 16 organizations are supplying over 2.3 million e-wallet accounts.

Vietnam strives for 95 percent of banks offering internet banking and mobile banking services, and 30 percent implementing digital banking, and all supermarkets, shopping centers and modern distribution centers allowing point of sale (POS) transactions, with over 300,000 POS devices to be installed.

Van said that orienting the development of digital technology in the sector is essential, as technology can facilitate the use of financial services.

According to the Nielsen Vietnam Smartphone Insight Report 2017, the number of smartphone users in 2017 accounted for 84 percent of the total mobile phone users in Vietnam, up 10 percent from the previous year. It means that Vietnam is potential to develop payment via mobile phones.

It is the reason why banks are stepping up QR code payment (QR Pay) on mobile phones. At present, consumers can make payment by using QR code on mobile banking apps of many banks, including Vietinbank, Vietcombank, BIDV, Agribank, Techcombank, and OCB.

Agribank is one of the first to apply QR code payment through its Agribank E-mobile Banking. Trinh Ngoc Khanh, Chairman of the bank’s Board of Members, said that one of the important tasks for the bank in the near future is to offer services based on high-tech platforms such as QR Pay, Samsung Pay and Autobank while improving services quality.

According to Pham Tien Dung, head of the Payment Department under the State Bank of Vietnam, to boost the non-cash payment and encourage new forms of payments, the Government issued a decision approving a project to step up payment of public services such as tax, electricity, water, school tuition and hospital fees on mobile phones.

Over the past two years, the application of non-cash and contactless payment methods in the country has risen. Statistics from the State Bank of Vietnam showed that financial transactions through mobile phones in 2017 rose by 81 percent while those made online also increased by 67 percent from the previous year.

The country now has 78 organizations providing online payment services and another 41 offering such services through mobile phones.

By the end of September 2017, the number of transactions through mobile phones in Vietnam topped 90 million, with a total value of VND 423 trillion (USD 18.63 billion).

Source: VNA