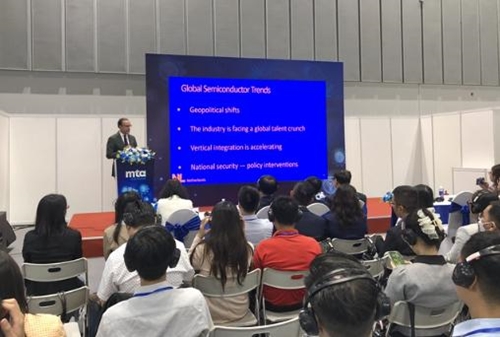

Speaking at “Vietnam’s Semiconductor Industry – Investment, Development & Collaboration Opportunities,” organized as part of the MTA Vietnam 2025, Daniël Stork, Consul General of the Netherlands in HCM City, emphasized the increasing strategic importance of semiconductors.

“Semiconductors are the backbone of our modern world. But recent events, especially the pandemic and growing geopolitical tensions, have exposed the fragility of global supply chains.

|

|

|

Daniël Stork, Consul General of the Netherlands in HCM City, speaks at the seminar “Vietnam’s Semiconductor Industry – Investment, Development & Collaboration Opportunities” in HCM City on July 2. |

“These disruptions have elevated semiconductors from a niche industrial concern to a matter of economic security and strategic autonomy.”

The global semiconductor market surpassed 600 billion USD in 2024 and is expected to exceed 1 trillion USD by 2030. But this growth is unevenly distributed.

Stork said Vietnam stands out as one of the most promising emerging players in the global semiconductor ecosystem.

It offers a blend of political and economic stability, a strategic geographical location, a young and tech-savvy workforce, a well-established electronics manufacturing base, and strong global integration, he said.

“Leading multinational companies like Amkor, Intel and Samsung already have significant operations here in packaging, testing and assembly. The launch of Vietnam’s National Semiconductor Development Strategy in 2024 shows a clear ambition to move further up the value chain into IC (integrated circuit) design, advanced materials and fabrication.”

Nguyen Que An, manager in deals advisory-transformation practices at PwC Tax and Advisory (Vietnam) Co., Ltd., said the Vietnamese semiconductor industry is projected to grow at an annual rate of 9% and reach 31.39 billion USD by 2029.

“Vietnam’s rise is being fueled by strong government support, foreign investment and global partnerships.”

The country offers an attractive tax regime for semiconductor investors, including corporate income tax breaks starting from October 2025, import duty exemptions on goods used in scientific, technological, innovative and digital projects, and VAT waivers for selected R&D and high-tech manufacturing activities.

Investors in high-tech zones also benefit from land-use privileges, such as extended leases of up to 70 years, reduced rental fees and priority access to advanced utilities and logistics infrastructure.

Vietnam has established dedicated zones to support semiconductor manufacturing with state-of-the-art infrastructure and tailored support services. These include Saigon Hi-Tech Park in HCM City, Hoa Lac Hi-Tech Park in Hanoi, and Danang Hi-Tech Park in Da Nang.

Overcoming bottlenecks

Speakers also highlighted key challenges facing Vietnam’s semiconductor sector.

Michael Lee, Director of the Global Procurement Division at Foxconn Technology Group, said, “Vietnam’s semiconductor industry is transitioning from a focus on geographical advantage to establishing a technological foothold. However, it faces four major bottlenecks: power supply, talent, technology, and supply chain. Building an integrated innovation ecosystem that connects policy, industry, and talent is key to overcoming these challenges.”

Stork offered recommendations to support Vietnam’s semiconductor ambitions such as investing in talent and ecosystems, forming trusted international partnerships, focusing on strategic niches, and supporting SMEs and auxiliary sectors.

“The foundation of any competitive semiconductor industry lies not only in manufacturing facilities but also in people. Engineers, researchers, and entrepreneurs are the long-term drivers of innovation. Building a skilled workforce and fostering research and startup ecosystems is essential.

“No country can thrive alone in this sector. By cultivating trusted international partnerships, Vietnam can accelerate capability development, reduce risks, and gain access to cutting-edge expertise.

“Rather than trying to cover the entire semiconductor value chain, Vietnam can position itself as a leader in selected areas such as advanced testing, chip design or specialized packaging, where it can develop world-class expertise.”

Stork also highlighted the importance of SMEs and auxiliary sectors.

“The semiconductor value chain is much broader than a few global giants. It requires high-level expertise in everything from metal processing and mechatronics to optics and engineering services.

“About 90% of the value of a chipmaking machine produced in the Netherlands comes from its supplier network. Vietnam should not overlook these auxiliary markets.”

Dutch companies like BESI, VDL ETG, Tecnotion, NXP and Sioux are expanding their presence in Vietnam, reinforcing the country’s growing role in the global semiconductor value chain.

Stork concluded by saying: “The Netherlands is ready to be a strategic enabler of Vietnam’s semiconductor aspirations through knowledge transfer, investment and ecosystem-building.”

Lee echoed his optimism, saying Vietnam is on track to become a major semiconductor exporter by 2030, thanks to rapid progress in mid- to low-end packaging and growing capabilities in specialty chip design.

These developments are positioning the country to play a more influential role in Southeast Asia’s semiconductor supply chain and potentially expand its global footprint.

Source: VNA